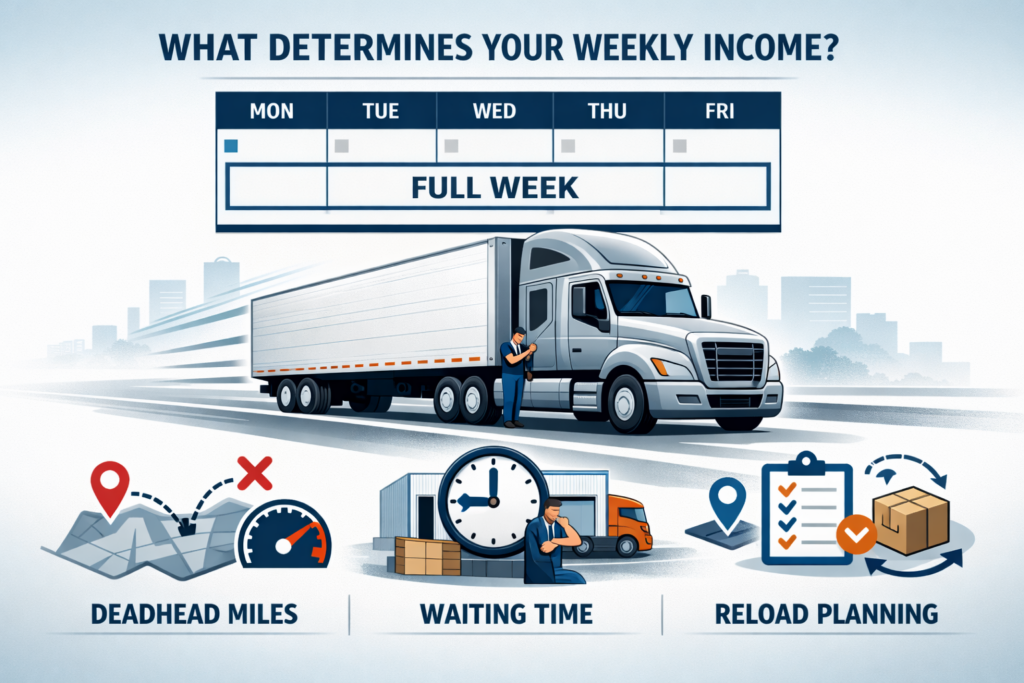

In trucking, erratic revenue is seldom due to bad freight. More often it is from weak connections between otherwise decent loads. Owner-operators have consistently told me about weeks during which rates appeared to be in balance, they did almost all of the miles, they ran and completed the boxes on compliance checks – but the week still didn’t go as well as they thought.

The difference between a good week of training and a frustrating week is not generally the rate on an individual load. It’s reload timing.

In trucking, reload timing is the measure of how well a delivery transfers to the next load of the same operating week – and is one of the best predictors of consistent income.

The Week, Not the Load, Is the Real Profit Unit

Industry benchmarks drive home a simple fact, that profit is made on a weekly basis, not load by load.

ATRI’s Operational Costs of Trucking indicates that non-revenue time – detention, deadhead and underutilized driven time – is now close to 20% of effective cost per mile for owner-operators. Fuel prices fluctuate and rates travel along with the market, and for lost time is extremely quiet and endless.

A typical target week of 2,800 paid miles that ends up at 2,350 miles that doesn’t fail because there just was no freight. It doesn’t work because time has been lost between loads – at docks waiting, repositioning for loads, sitting in slack outbound markets. At an average $2.20 per mile, the difference comes out to almost $1,000 in lost gross revenue without one “bad” load on the books.

Detention and Waiting Time: The First Silent Profit Leak

FMCSA data and shipper behavior both attest to the fact that detention over two hours is still widespread, even though contractual language is in place to limit it. For a solo operator, three hours of waiting several times a week soon adds up.

Nine lost hours in a week is equal to about 450 miles able to be driven. Detention pay, we know it exists, but in any case, detention pay barely covers the downstream effects: missing load windows, forced overnight wait, and decreased scheduling flexibility.

Waiting is not reflected on rate confirmations, but it always determines if a week holds together.

Reload Geography: Why Where You End Matters More Than Rate

Load boards are good at showing rates. They do not reveal the load reload depth.

A continual analysis of industry lane data reveals that palletized markets have favorable same-day or next-day reloading capabilities—with thin markets, 150 or 300 unpaid repositioning miles are added on a weekly basis. A $3.00 per mile load into a weak market often happens to be a losing move compared to a $2.40 per mile load into a strong one after deadhead and waiting are considered.

ATRI estimates average deadhead in the 15-20% range for the owner-operators. Poorly planned weeks often rack up more than 25% where fuel costs, maintenance costs, and fixed costs continue to add up and the revenue miles decline. The math does not excuse geography.

Appointment Compression and Why Tight Schedules Break Weeks

Tightly packed appointments appear very efficient on paper. In practice, they are bringing fragility.

A typical pattern appears like this: A Thursday delivery runs three hours late, the Friday reload gets in the afternoon, and the only option remaining puts the truck into a weak outbound lane. The rate looks fine on paper, but the week closes short—not due to bad freight but to violating timing.

Once timing has slipped, the choices regarding recovery become quite limited fairly fast. Reloads are decreased, and negotiation leverage is lost, and the rest of the week ends up being reactive.

Why Load Boards Don’t Show the Full Picture of Weekly Performance

Load boards work on the basis of snapshots of supply and demand. They answer the question of what is available now and not how a decision today affects what is available tomorrow.

They do not factor in lane continuity, appointment flow, or reload reliability. As a result, drivers with single-load bookings often optimize short-term rates at the cost of weekly utilization. Over time, this results in not-so-consistent results even if individual loads seem to be good.

This is why various experienced operators take a little lower headline rates in order to protect flow—a pattern explored in How Dispatch Support Helps Truck Drivers Stay Loaded, as well.

Why Weekly Planning Outperforms Load-by-Load Optimization

Drivers who consistently outperform industry averages are week thinkers, or strategic.

They gravitate to the repeat lanes, known shipper behavior and markets where the loaded pattern can be predicted. Deadhead is used as a positioning tool and not a reaction to emergency. This approach is consistent with ATRI’s findings that time efficiency – not just rate per mile – is the key to profitability.

Small uses of improvement compound rapidly. Isolated spikes in the rate do not often do this.

For a more in-depth breakdown of the process quiet deadhead damages weekly performance see The Guide to Managing Empty Miles in Trucking.

Why Skilled Drivers Still Struggle With Reload Timing

Most owner-operators are at once running drivers, sales, scheduling, compliance, paperwork and negotiation. Under the burden of that workload, planning is frequently reactive out of necessity.

Reloads are searched for after delivery rather than before. Lane strategy is changed in the middle of the week. Rate discussions occur under time rather than leverage. This is not due to a lack of discipline or lack of experience – it is a capacity constraint.

Where Dispatch Planning Changes the Equation

Dispatch is not a supplier of freight. It reduces waste.

At best case scenario, dispatch planning is about putting loads together in an achievable week, where reloading loads prior to delivery, navigating to freight dense lanes, (the time for the broker communication) and negotiating rates without losing timings.

Going from 25% deadhead to 18% deadhead on a 2,800-mile target week recovers almost 200 paid miles. That is the result of an increase in structure, not a market fluke.

Predictability Beats Peak Rates

In volatile markets, operators that guard against utilization and time consistently sharpen against those chasing isolated high paying loads. Predictable Weeks = Steadier Income, Less Stress, and Sufficient Decision Making.

Perfect loads are rare. Controlled weeks can be replicated.

Conclusion

Good loads do not lead to good weeks and the data makes that clear.

Weekly performance is determined by paid-mile percentage, reload positioning, waiting time and planning discipline. Operating operators who assess loads in isolation tend to lose in between them. Those who plan over the whole week – both alone and with support – save on waste and stabilize the outcome.

In trucking the actual competitive advantage is not finding the best load.

It is build up weeks hold them together.

👉 Contact Dexter Dispatch Services at www.dexterdispatchservices.com or call us at [682-336-0385]